Home » About Us

One firm, Two strategies

Argos Wityu is an independent European private-equity group that supports the growth of mid-sized business and back their management teams.

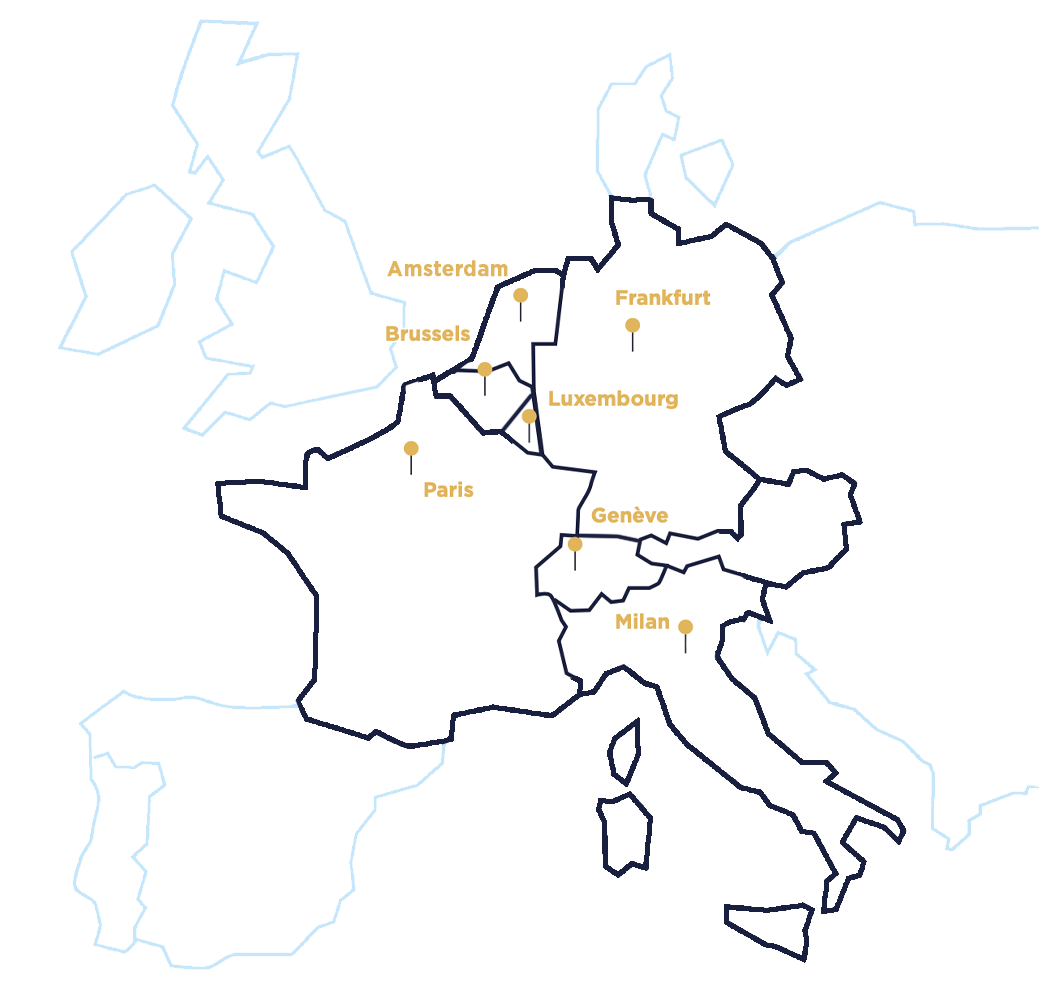

With more than €1.8bn assets under management, over 30 years of experience and more than 90 businesses assisted, Argos Wityu operates from offices in Amsterdam, Brussels, Frankfurt, Geneva, Luxembourg, Milan, and Paris. The group seeks to acquire majority stakes and invests between €10m and €100m in each investment of its two strategies:

The Argos Mid-Market fund helps companies implement ownership transitions to accelerate growth

- The Argos Climate Action fund (SFDR 9) aims at shaping European sustainable leaders by making their ‘grey-to-green’ transition.

“Success is the result of human intervention, not reports."

Seven Offices with Strong Local Roots

We have developed our presence by putting down deep roots in each country. Argos Wityu is present in Amsterdam, Brussels, Frankfurt, Geneva, Luxembourg, Milan and Paris.

Our Investment Criteria

The group seeks to acquire majority stakes and invests between €10m and €100m in each investment

MBO /MBI

Management buy-out.

Management buy-in.

Spin-offs / Carve-outs

Growth capital/Build-up

Capital increase to finance a company’s internal growth and acquisitions.

Specialist in Atypical Solutions

Strengthening management teams

Spin-offs

Carve-outs

Business arbitrage

Reconfiguration

Enhancing ESG

initiatives

Shareholder issues Rebuilding structure eg. dispersed, privatizations

Our Way of Working

Our teams spend time every day with management to brainstorm growth opportunities and solve challenges together.

We give companies the freedom to take operational initiatives and invest in their strategic plans. We believe this is the way to create value. Our approach is much more than a purely financial one.

Limited Recourse to Debt

Our Way of Working

Our teams spend time every day with management to brainstorm growth opportunities and solve challenges together.

We give companies the freedom to take operational initiatives and invest in their strategic plans. We believe this is the way to create value. Our approach is much more than a purely financial one.

Limited Recourse to Debt

How We Operate

Step 1

Raising a fund

The first stage of an investment fund is arguably the least publicised. It consists in convincing investors to entrust us with the funds we will use in stage two of our work: investing.

We raise funds based on the investment strategy we present to investors. We work with a wide range of investors, including institutions, pension funds, family offices and private individuals. Our investors are mainly located in Europe, the USA and Asia. Most of them have been working with us for many years.

We provide our investors with regular updates and calls and host bi-annual investors’ meetings to review in detail the performance and development of the portfolio of companies in which they have invested. Of course, we also provide quarterly reports that present our view on the financial and economic landscape of the pan-European market in which we have developed expertise. These reports meet the most exacting standards.

List of funds we have raised since Argos Wityu was created:

- Euroknights I & II: €59.9m, 1990-93

- Euroknights III: €106.7m, 1996

- Euroknights IV: €144.5m, 2000

- Euroknights V: €275m, 2006

- Euroknights VI: €400m, 2011

- Euroknights VII: €520m, 2017

- Mid-Market VIII: €450m 2021

Step 2

Investing

This phase starts with reciprocal discovery of the business and of the people. It is equally important for the management team to understand who we are, what our expectations are and how we operate as it is for us to understand who they are.

Partnering means embarking on a journey together that lasts several years. Our future partners need to ensure we share their understanding of business opportunities and challenges. We need to share management’s conviction, agree that reality will probably be different, trust each other and adapt the plan.

Of course, every investment process includes due diligence and the drafting of legal documentation. But we will not invest if there is not a sense of mutual trust or if we are not comfortable with the level of transparency that has been established. Nor will we invest if our interests are not perfectly aligned with those of the management team. We believe that once the investment is made and the journey begins, we must all pull in the same direction. There must be no hidden agendas.

Step 3

Right after the investment

The weeks and months right after an investment deserve a specific focus. This is when the new dynamics kick in.

We launch the new initiatives discussed before the investment, and we implement the new governance, as explained below. Often a lot of time is dedicated to explaining the purpose of the new partnership to stakeholders, i.e. clients, suppliers, and especially employees.

Indeed, at Argos we feel it is important to explain to employees who we are, where the new money is coming from, and what our purpose is. We have done this many times over the past 30 years, and it has always been a fruitful experience for everyone involved.

Step 4

Working together during the investment period

We do not manage the companies in which our funds invest. Management does.

We have a dual role alongside management during the investment period. As a majority investor, having invested funds deriving from the savings of millions of people, we must carefully monitor the progress of the business. There is a formal aspect to this, with monthly reports and Board decisions.

Our second role goes far beyond the first. Our 30 years of successful support to mid-sized businesses in many industries and situations – accelerating business plans and overcoming difficulties – have taught us a great deal about how to help businesses grow and become stronger.

The method is simple: an open and informal dialogue with management teams. Typically, we talk every week, without any agenda other than sharing where the business and its market are going and considering how to make the company stronger in that evolving context.

Step 5

Divesting

We are often asked why we need to divest at all.

The money we invest comes from institutions that invest the long-term savings of people. But even their “long-term” savings have a time limit. They might want to buy a house, retire or put their money to some other use. So these institutions cannot keep their investment in our funds forever.

On average our investment period is slightly more than five years, but this period is not set in stone. In many cases, we have continued to oversee growth for seven to ten years.

Usually our divestments follow a structured process, closely coordinated with the company’s management. All options are open. In most cases, another fund manager teams up with the company. The quality of the new business plan is taken into consideration. Care for sustainability does not end on the eve of our divestment.

Step 6

Return funds to investors

Step 1

Raising a Fund

The first stage of an investment fund is arguably the least publicised. It consists in convincing investors to entrust us with the funds we will use in stage two of our work: investing.

We raise funds based on the investment strategy we present to investors. We work with a wide range of investors, including institutions, pension funds, family offices and private individuals. Our investors are mainly located in Europe, the USA and Asia. Most of them have been working with us for many years.

We provide our investors with regular updates and calls and host bi-annual investors’ meetings to review in detail the performance and development of the portfolio of companies in which they have invested. Of course, we also provide quarterly reports that present our view on the financial and economic landscape of the pan-European market in which we have developed expertise. These reports meet the most exacting standards.

List of funds we have raised since Argos Wityu was created:

- Euroknights I & II: €59.9m, 1990-93

- Euroknights III: €106.7m, 1996

- Euroknights IV: €144.5m, 2000

- Euroknights V: €275m, 2006

- Euroknights VI: €400m, 2011

- Euroknights VII: €520m, 2017

- Mid-Market VIII: €450m 2021

Step 2

Investing

This phase starts with reciprocal discovery of the business and of the people. It is equally important for the management team to understand who we are, what our expectations are and how we operate as it is for us to understand who they are.

Partnering means embarking on a journey together that lasts several years. Our future partners need to ensure we share their understanding of business opportunities and challenges. We need to share management’s conviction, agree that reality will probably be different, trust each other and adapt the plan.

Of course, every investment process includes due diligence and the drafting of legal documentation. But we will not invest if there is not a sense of mutual trust or if we are not comfortable with the level of transparency that has been established. Nor will we invest if our interests are not perfectly aligned with those of the management team. We believe that once the investment is made and the journey begins, we must all pull in the same direction. There must be no hidden agendas.

Step 3

Immediately following the investment

The weeks and months right after an investment deserve a specific focus. This is when the new dynamics kick in.

We launch the new initiatives discussed before the investment, and we implement the new governance, as explained below. Often a lot of time is dedicated to explaining the purpose of the new partnership to stakeholders, i.e. clients, suppliers, and especially employees.

Indeed, at Argos we feel it is important to explain to employees who we are, where the new money is coming from, and what our purpose is. We have done this many times over the past 30 years, and it has always been a fruitful experience for everyone involved.

Step 4

Working together during the investment period

We do not manage the companies in which our funds invest. Management does.

We have a dual role alongside management during the investment period. As a majority investor, having invested funds deriving from the savings of millions of people, we must carefully monitor the progress of the business. There is a formal aspect to this, with monthly reports and Board decisions.

Our second role goes far beyond the first. Our 30 years of successful support to mid-sized businesses in many industries and situations – accelerating business plans and overcoming difficulties – have taught us a great deal about how to help businesses grow and become stronger.

The method is simple: an open and informal dialogue with management teams. Typically, we talk every week, without any agenda other than sharing where the business and its market are going and considering how to make the company stronger in that evolving context.

Step 5

Divesting

We are often asked why we need to divest at all.

The money we invest comes from institutions that invest the long-term savings of people. But even their “long-term” savings have a time limit. They might want to buy a house, retire or put their money to some other use. So these institutions cannot keep their investment in our funds forever.

On average our investment period is slightly more than five years, but this period is not set in stone. In many cases, we have continued to oversee growth for seven to ten years.

Usually our divestments follow a structured process, closely coordinated with the company’s management. All options are open. In most cases, another fund manager teams up with the company. The quality of the new business plan is taken into consideration. Care for sustainability does not end on the eve of our divestment.

Step 6

Return funds to investors