MORE THAN 90 SMEs

SUPPORTED

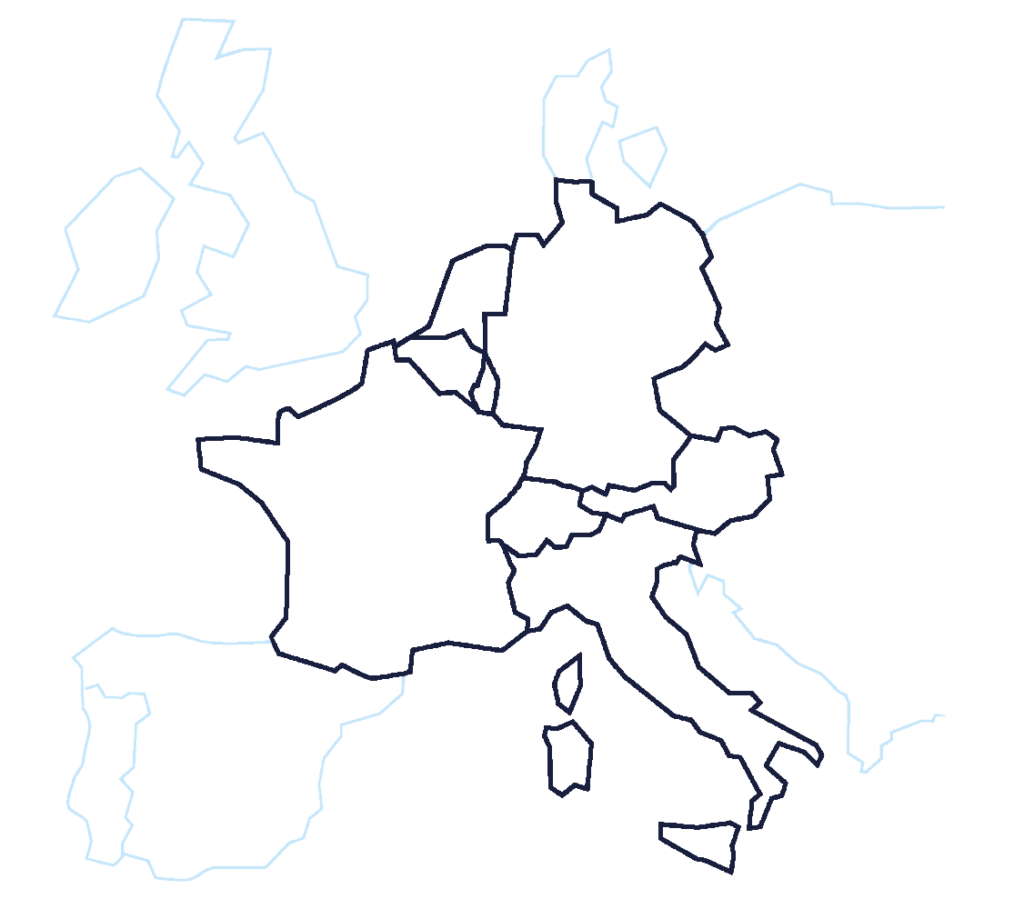

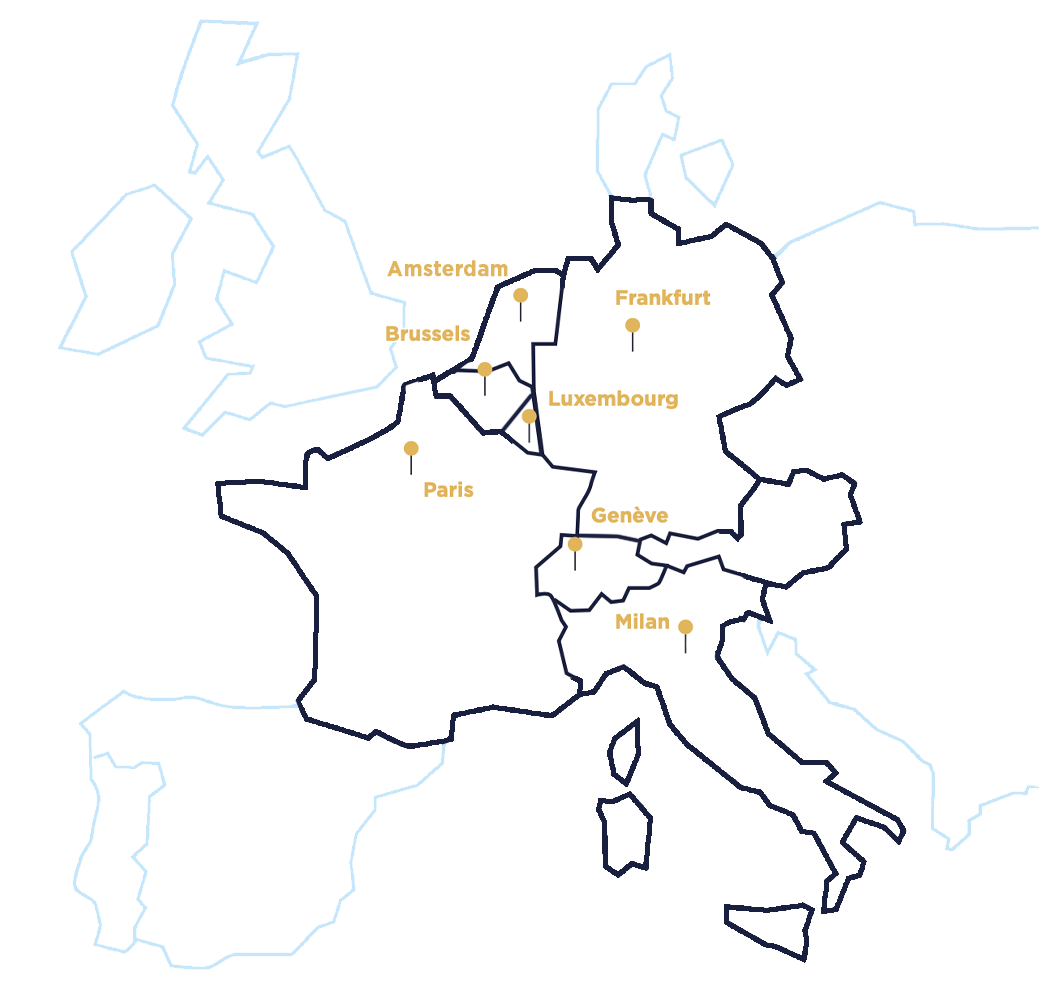

7 OFFICES IN

EUROPE

OVER 30 YEARS

EXPERIENCE

OVER €1.8 BILLION

UNDER MANAGEMENT

European Investment Fund

A Wide Range of Sectors

A Wide Range of Sectors

Tech

Food

Goods

Aeronautics

Services

Industry

Transport

Leisure

Our CEOs

Arjan & Harry Schenk

CEOs of Schenk — The Netherlands

Bas Ambachtsheer

CEO of IJssel

— The Netherlands

Jeroen Ekkel

CEO of Cohedron — The Netherlands

Seven Offices, One Team

Our international dimension is an essential part of our identity. Argos Wityu was founded in 1989 with offices in Geneva, Milan and Paris. We then opened offices in Brussels, Frankfurt, The Netherlands and Luxembourg.

The attractiveness of the companies we support also depends on their ability to respond to social and environmental issues. Today, we have higher standards, ethics being the oldest notion at Argos Wityu.

Signatory of the International Climate Initiatives (iCI) and PRI (Principles of Responsible Investment), we commit ourselves to integrate the responsibility criteria into our management and investment policies.

Our talents

Rainer Derix

Partner — Dach

Coralie Cornet

Head of Communication and Digital — France

Olivier de La Gueronniere

General Secretary — Benelux

Join Us

You are often asked why you would like to join us.

Let us first tell you why you should join us!

Join Us

You are often asked why you would like to join us.

Let us first tell you why you should join us!

Argos Index® mid-market

To receive our Argos Index®, subscribe to our contents

News

Mid-market Argos Index® for the second quarter of 2024

The mid-market Argos Index® for the second quarter of 2024, published by Argos Wityu, the independent European investment fund, and Epsilon Research, the online platform for the management of unlisted M&A transactions, is now available. Launched in 2006, this index tracks the valuations of unlisted eurozone SMEs in which a majority stake has been acquired during the last six months.

Argos Wityu in exclusive negotiations to sell Coexya to the Talan group.

Argos Wityu, an independent pan-European investment group, has entered into exclusive negociations with Talan, an international consulting and technology expertise group that accelerates its customers’ transformation through technology, innovation and data, with a view to selling Coexya, a specialist in various aspects of digital transformation with more than 20 years of experience in consultancy, integration and software development. The Coexya group is majority-owned by the Argos Mid-Market VII fund.

Julhiet Sterwen joining forces with (RE)SET, a consulting firm specialised in the economic and environmental transition.

Strategy, transformation and innovation consulting company Julhiet Sterwen and (RE)SET have announced they are merging. Together with (RE)SET, the Julhiet Sterwen group, a mission-based company known for its commitment to Consulting for Good, will be a consulting powerhouse in sustainable environmental, economic and social transitions.