Home » Sustainability

Our Sustainability Approach & Related Disclosures

Investing in Sustainable Growth

Long before ESG became part of the private equity landscape, we recognised that corporate social responsibility enabled companies to improve their growth prospects and better manage risks, reduce resource consumption and improve operational efficiency. It’s common sense. We created Argos Wityu with ESG as a source of innovation and new opportunities.

Our Commitments

Argos Wityu has recognised decarbonisation as a key action for each portfolio company. Each company we support is required to measure the current level of its carbon footprint and define targets to further reduce this level over the next couple of years. To support our portfolio companies in the best possible way and to provide best practices, we have committed to dedicated initiatives on this topic.

UNPRI

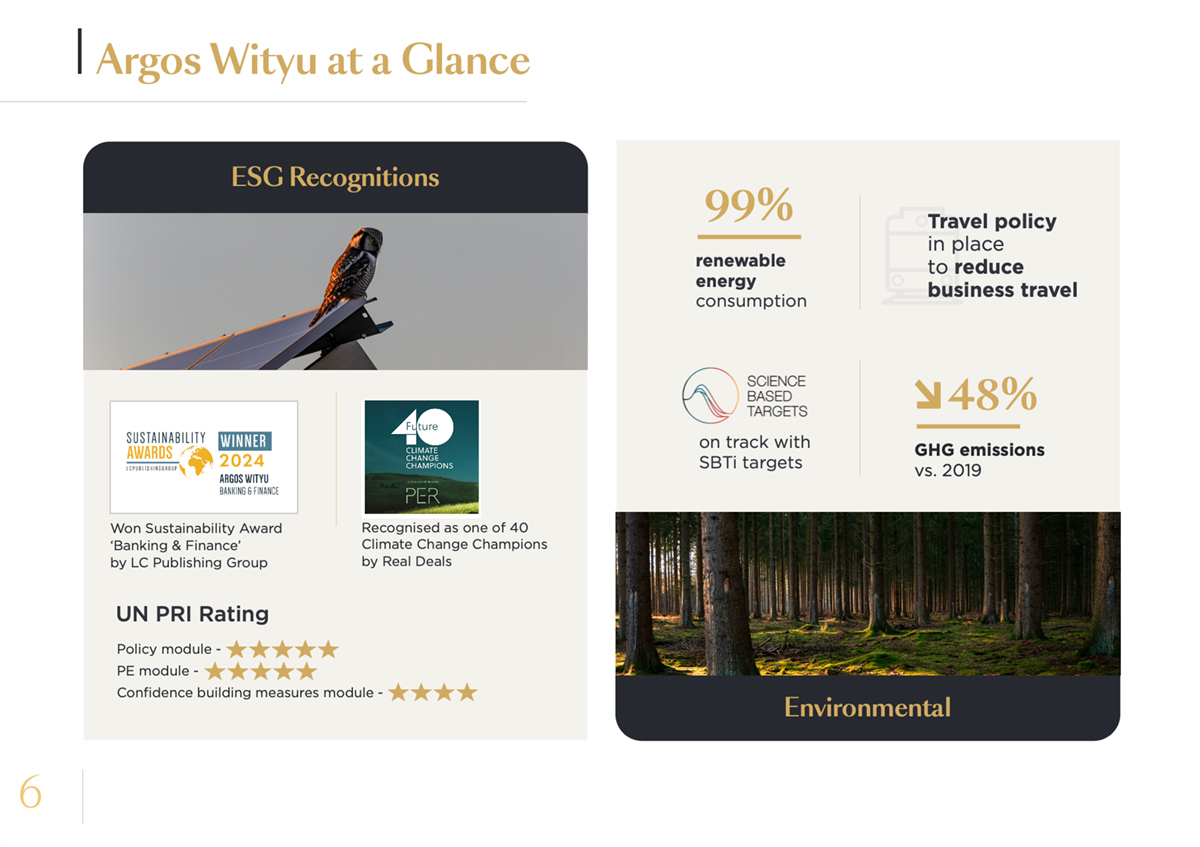

Argos Wityu is proud to have joined the UNPRI (UN Principles for Responsible Investment) in February 2021. While we have always been committed to applying leading ESG principles in our practices, by joining UNPRI, Argos Wityu has fully committed to making ESG a part of its core mission.

By joining the UNPRI, Argos Wityu is committed to applying the group’s guidelines throughout the investment, portfolio management, and divestment processes, as well as in the management of our own company. Becoming a PRI signatory highlights Argos Wityu’s efforts in sustainable and responsible investment.

iCI

As an ICI (Initiative Climat International) signatory, Argos Wityu is committed to reducing the greenhouse gas emissions of the companies it supports and to ensuring sustainable performance.

The ICI forms a unique sharing platform that brings together and mobilises all private equity players wishing to make a concrete contribution to the fight against climate change.

UN Global Compact

As we are committed to further integrating sustainability, we have signed up for the UN Global Compact.

Besides publishing our annual report, we will be able to access best practice guidance, tools, resources, and training to share both internally and with our portfolio companies.

Invest Europe

Argos Wityu is a historic member of InvestEurope. Having joined the Responsible Investment Roundtable’s Affiliate Network, Argos Wityu shows its commitment to supporting ESG in the European private equity industry.

Fabian Söffge has been a member of the working group on ESG Reporting Standards since 2022, which tries to harmonise reporting standards and focus on those KPIs being relevant to both Limited Partners and General Partners.

Science Based Targets

Science-based targets are greenhouse gas emission reduction targets that are informed by independent climate science and are in line to meet the goals of the Paris Agreement –limiting global warming to well below 2°C above pre-industrial levels and pursuing efforts to limit warming to 1.5°C.

Argos Wityu has committed in April 2022 to set SBTs and has submitted the defined targets to the SBTi for approval in June 2022.

France Invest

Argos Wityu is a historic member of FranceInvest. Under the Presidency of Louis Godron (2012-2014), the professional federation adhered to the PRI; it also notably designed a Code of Conduct related to responsible investment, which was published in 2013 and adopted by the industry.

Our partner Simon Guichard has joined the steering committee of the France Invest Sustainable Commission as of 2022. He is representing Argos Wityu as the GP leading the working group Portfolio Decarbonisation, which helps GPs develop and implement methods to support their portfolio companies in their decarbonisation roadmap.

Key Figures 2022

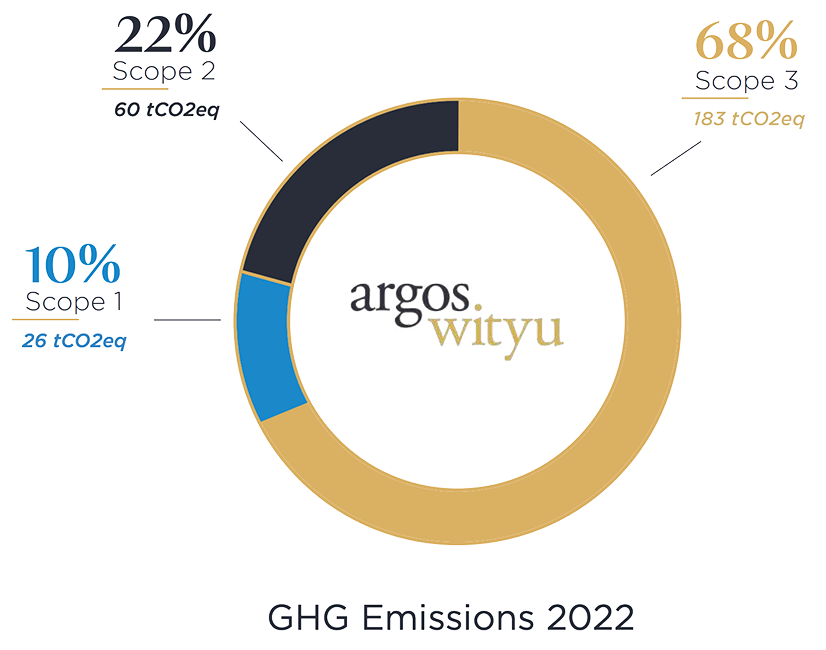

Environment

On an annual basis, we calculate our GHG emissions. As we are improving the quality of our portfolio companies’ GHG calculations and thus to fully calculate our scope 3 category 15 (investments), we will include this category in the near future to improve the level of detail of our carbon footprint.

Argos Wityu sets ambitious science-based targets (SBTs) for reducing greenhouse gas emissions (GHG) for its own operations.

- Reduce its own absolute scope 1 and 2 GHG emissions by 46%.

- Reduce total scope 3 GHG emissions, from categories 1 to 14, by 58% per sales.

- Reduce total scope 1, 2 and 3, categories 1 to 14, GHG emissions by 7.5% annually per sales, a voluntarily addition to the official SBTs at management company level.

Social

Our employees play a key role in our portfolio companies’ success and the achievement of our goals. We have set several actions in place to improve diversity within our teams and are highly committed to provide the necessary training and development.

1080€

average training budget per FTE

36%

women of total headcount

9%

women within investment team

80%

of “Head of” roles are filled by women

21%

turnover rate

Governance

Beyond being in conformity with the regulations, the fight against money laundering and the financing of terrorism is a moral obligation that also protects the reputation of a large group like ours. Despite our presence in several European countries, we are committed to providing mandatory training to all group employees, including managers, to make them aware of the risks of money laundering and fraud in general. We accompany the investment teams in their daily portfolio monitoring so that they manage their business in an ethically responsible manner. And being available to the managers of the portfolio companies in order to share our best practices supports the fight against money laundering effectively.

100%

of our employees are trained on the Anti-Money Laundering Policy

82%

of portfolio companies with an ESG action plan

Actions within our Portfolio Companies

Roadmaps

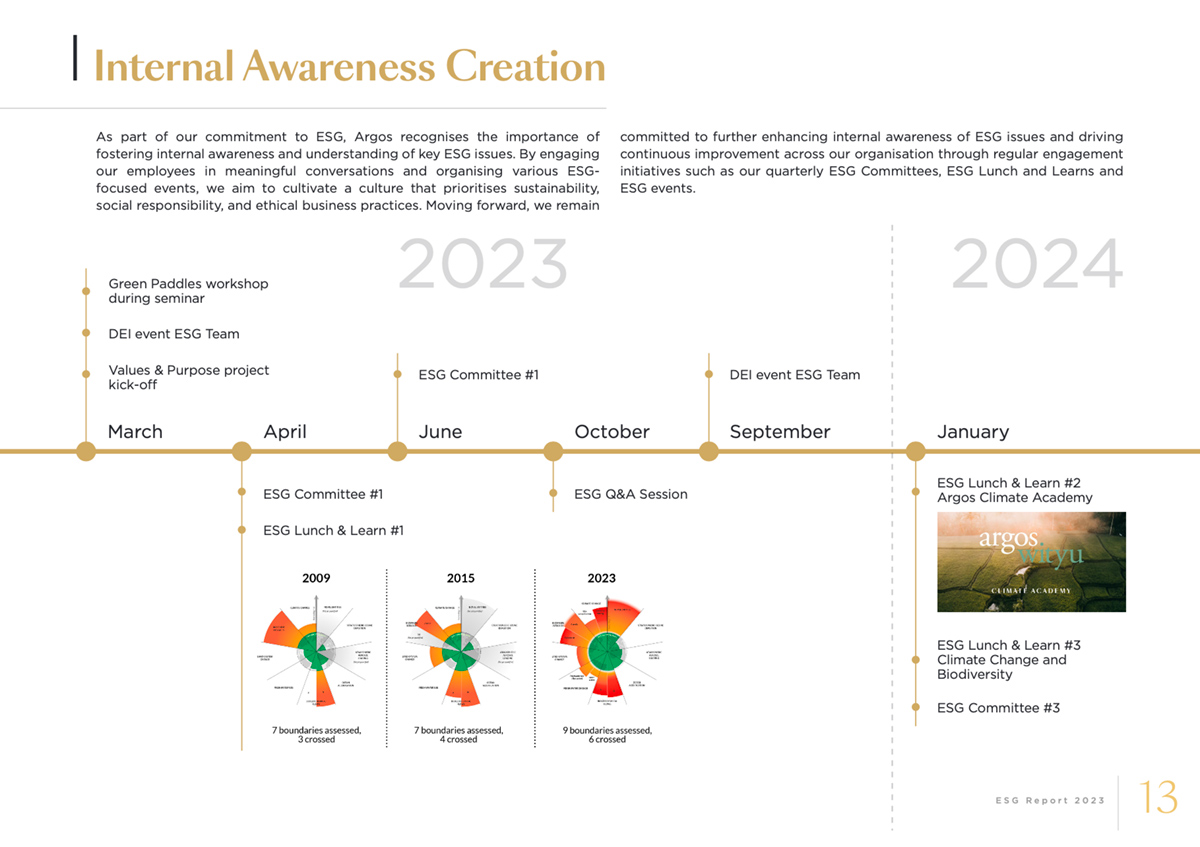

As part of integrating sustainability into our portfolio companies, we organise workshops together with management teams, providing insights and tips. The workshops aim to create sustainability awareness and support the company in developing initiatives to further implement sustainability which can be visualised in a roadmap. Hereafter, our portfolio companies are self-steering in their sustainability strategy and implementation and can rely on support from our Head of ESG where needed.

Example of visualization of one of our portfolio companies.

“There are usually many questions about sustainability at the start. However, at the end of the workshop, the team is fully aware of the benefits and opportunities it can provide them.”

Jessica Peters

Head of ESG

ESG With You

ESG With You is a series of Documentary shorts presenting outstanding initiatives by Companies we support.

Rewind, the reference platform for second-hand Henri Selmer Paris instruments.

Discover the story of a 1932 Henri Selmer Paris Saxophone that was recently found in an attic. Slowly, it is reborn under the care of a magical craftsman before finding a new life.

Since 1885, more than 850 000 saxophones, 350 000 clarinets and 100 000 brass were produced. They all deserve a new life.

Creation of an ice-cream range with fresh local French milk by La Compagnie des Desserts.

After the 2009 milk crisis, the Mar’Gaude dairy farm is in freefall. See how its encounters with a new partner, La Compagnie des Desserts, forges a new path.

120 000 litres of milk were ordered to the farm in 2021, accounting for 30% of its revenues.

Our Head of ESG’s Vision

ESG Documentation

Article 29 Loi Energie et Climat (France)

The policy aims to present how Argos Wityu measures and integrates ESG into its investment process. And, in compliance with the Sustainable Finance Disclosure Regulation (SFDR), we describe how we integrate the sustainability risks into our investment decision-making process in line with Article 3 of SFDR.

This policy shows how Argos Wityu considers and assesses climate risks in its investment cycle, with a specific focus on the Argos Climate Action fund dedicated to the energy transition.

This excerpt of Argos Wityu’s remuneration policy aims to address the article 5 of SFDR regulation on the transparency of the remuneration process in relation to the integration of sustainability risks.

Diversity and Inclusion Policy

SFDR requires financial market participants to make a ‘comply or explain’ decision on whether they consider principal adverse impacts (“PAIs”) of investment decisions on sustainability factors. Argos Wityu considers PAIs in its investment process. This statement on PAI has been drafted in line with article 4 of SFDR and covers the reference period from 1 January to 31 December 2023.