Acquisition prices of unlisted European SMEs continue to decline, but remain high, at 10.0x EBITDA.

Paris (France) – 18 February 2022 – Argos Wityu, the independent European investment fund, and Epsilon Research, the online platform for the management of non-quoted M&A transactions, today published the Mid-market Argos Index® for the fourth quarter of 2021. This index, launched in 2006, tracks the valuations of eurozone private, mid-market companies in which a majority stake has been acquired during the last six months.

Acquisition prices of unlisted European SMEs have corrected once again.

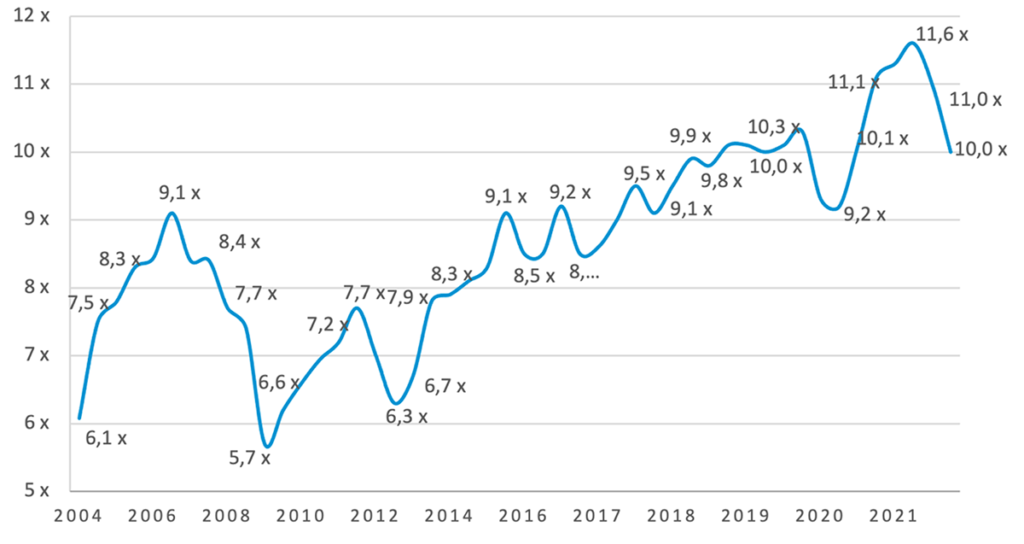

Multiple median EV/EBITDA, 6-mo. rolling basis – Source: Mid-market Argos Index® / Epsilon Research

- In the fourth quarter of 2021, the Argos Index® continued the correction it started in the third quarter, declining to 10.0x EBITDA. This level, although still high, corresponds to the average of the last five years (2017-21).

- The spread of multiples between the tech-healthcare and manufacturing-services sectors is very significant, at more than 4x EBITDA on average.

- The index’s decline reflected concerns about the consequences of the successive Covid-19 waves, the breakdown of value chains, the sharp rise in energy and raw materials prices and the likelihood of renewed inflation.

Renewed market coherence, with convergence in the prices paid by investment funds and strategic buyers.

- Multiples paid by investment funds declined by 11.5% this quarter to 10.0x EBITDA. They continued the correction they started in the third quarter after reaching a record level in the second quarter.

- This decline remained tied to the reduction in the proportion of healthcare and technology sector transactions.

- Prices paid remained high, however, driven by exceptional financing conditions and an abundance of capital looking for investments.

- Multiples approached those paid by strategic buyers (9.9x EBITDA), with competition on high-quality assets remaining intense.

More dispersion in multiples

- In the fourth quarter of 2021, the dispersion of multiples within the sample was high and related in particular to the business sector.

- 26% of transactions were closed at multiples in excess of 15x EBITDA, a new record, and 15% at multiples less than 7x EBITDA.

Listed companies were once again very active, even though the multiples they paid declined.

- Multiples paid by strategic buyers were down in the fourth quarter, at 9.9x EBITDA even though M&A activity, particularly that of large groups, remained buoyant. Large groups represented 72% of strategic buyers in the second half.

- This decline was in line with that of the multiples of listed companies.

The volume of mid-market M&A activity remained high

- Fourth-quarter M&A activity increased by 2% in volume, remaining at a high level, but declined 13% in value terms.

- The growth in mid-market activity was not as robust as that of global M&A activity, which, driven by the largest acquisitions, grew by more than 60% in volume in 2021 to $5.8tn , the highest level in 40 years.

Argos Wityu

Coralie Cornet

Head of Communications

ccc@argos.fund

+33 6 14 38 33 37

About Argos Wityu / www.argos.wityu.fund

Argos Wityu is an independent European investment fund that supports companies in the transfer of business ownership. It has assisted more than 80 entrepreneurs, focusing its investment strategy on complex transactions with emphasis on transformation, growth, and close collaboration with management teams. Argos Wityu seeks to acquire majority interests and invest between €10m and €100m with each transaction. With more than €1bn under management and 30 years of experience, Argos Wityu operates from offices in Brussels, Frankfurt, Geneva, Luxembourg, Milan and Paris.

Epsilon Research developed the first online platform for the management of non-quoted M&A transactions, aimed at M&A professionals. The Epsilon platform includes data, analysis reports, software and services essential for private company valuation / deal management: EMAT, the largest database of European private company transaction multiples, with detailed analysis of 8,000 M&A deals, ranging from €1m to €500m in value, covering all industry sectors; indices and studies published regularly by Epsilon, including the Argos Index; cloud-based software for managing M&A contacts and projects; valuation of comparable private equity fund investments.

The Mid-market Argos Index® tracks the valuation of unlisted mid-market companies in the eurozone. Carried out by Argos Wityu and Epsilon Research and published every three months, it reflects median EV/EBITDA multiples, on a six-month rolling basis, of transactions meeting the following criteria: mid-market (equity value between €15m and €500m for 100%), target based in a eurozone country, acquisition of a majority stake, certain activities excluded (financial services, real estate, high-tech).