Fonds d‘Investissement Européen

Argos Wityu est un fonds d’investissement européen indépendant qui accompagne la transmission de PME et ETI. Depuis plus de 30 ans, nous identifions la manière de révéler le potentiel des entreprises que nous accompagnons en leur permettant d’innover et de croître tout en générant une valeur considérable et durable.

Une Large Gamme de Secteurs d'Activités

Une Large Gamme de Secteurs d'Activités

Tech

Alimentaire

Goods

Aéronautique

Services

Industrie

Transport

Sport

Nos CEOs

Arjan & Harry Schenk

CEO de Schenk – Pays Bas

Bas Ambachtsheer

CEO de IJssel — Pays Bas

Jeroen Ekkel

CEO de Cohedron – Pays Bas

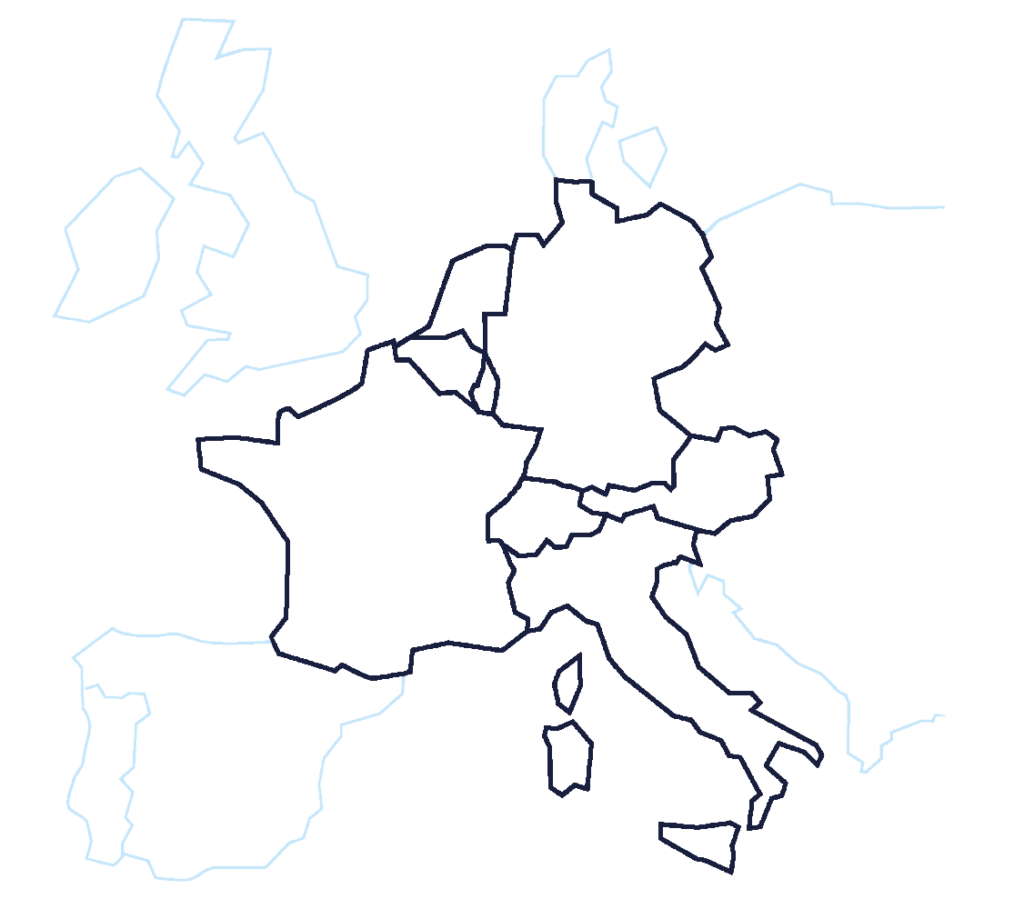

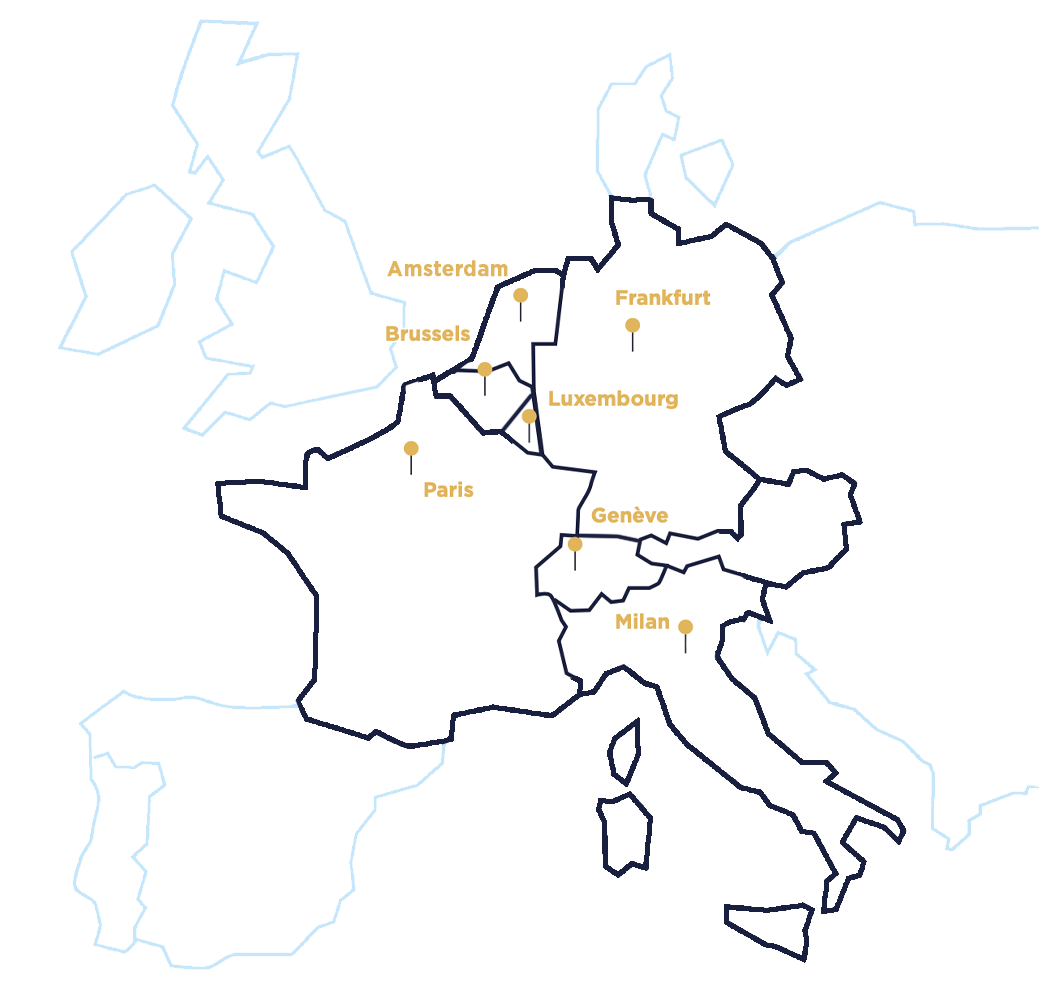

Sept Bureaux pour un Ancrage local fort

Nous avons développé notre présence en nous enracinant profondément dans l’environnement de tous nos pays. Argos Wityu est présent à Bruxelles, Francfort, Genève, Luxembourg, Pays-Bas, Milan et Paris.

L’attractivité des sociétés que nous accompagnons dépend aussi de leur capacité à répondre à des enjeux sociaux et environnementaux. Aujourd’hui, nous avons des exigences plus grandes, l'éthique étant la notion la plus ancienne chez Argos Wityu.

Argos Wityu a signé le PRI en 2021 pour intégrer la mise en place des « Pratiques d’investissement Responsable » visant à intégrer les questions ESG dans ses décisions d’investissement.

Nos Talents

Rainer Derix

Partner — DACH

Coralie Cornet

Directrice de la Communication — France

Olivier de La Gueronniere

Secrétaire Général — Benelux

Rejoignez-Nous

On vous demande souvent pourquoi vous aimeriez nous rejoindre.

Laissez-nous d’abord vous expliquer pourquoi vous devriez nous rejoindre !

Rejoignez-Nous

On vous demande souvent pourquoi vous aimeriez nous rejoindre.

Laissez-nous d’abord vous expliquer pourquoi vous devriez nous rejoindre !

Argos Index® mid-market

Pour recevoir l’Argos Index®, inscrivez-vous

Actualités

Gantrex Group, société accompagnée par Argos Wityu, acquiert Liftcom

Fondé en 1971, Gantrex est le leader mondial des solutions d’ingénierie pour rails de grues et voies ferrées spécialisées. Les produits du groupe sont utilisés dans de nombreuses applications différentes et sur de nombreux marchés, ports, chantiers navals, aciéries, fonderies d’aluminium, dépôts ferroviaires et industries lourdes. Le groupe réalise un chiffre d’affaires de 113 millions d’euros, emploie environ 450 collaborateurs dans plus de 20 pays, et dessert plus de 3 000 clients partout dans le monde.

Rapprochement entre Agôn Electronics et Tronico, deux leaders des produits électroniques pour les environnements critiques

Tous deux acteurs de premier plan, Agôn Electronics et Tronico conçoivent des systèmes électroniques pour répondre aux situations les plus complexes, aux enjeux les plus critiques, aux contraintes opérationnelles les plus fortes. Les deux groupes sont spécialisés dans la sous-traitance électronique (EMS) d’une part, et dans la conception de produits propres d’autre part. Ils conçoivent et fabriquent des produits et des cartes électroniques, fiables et de haute technicité, pour les secteurs les plus exigeants de l’aéronautique, du ferroviaire embarqué, de l’énergie, du spatial ou du médical.

Argos Index® mid-market 4ème trimestre 2023

Argos Wityu, fonds d’investissement européen indépendant et Epsilon Research, plateforme en ligne pour la gestion des opérations M&A non cotées, publient ce jour l’Argos Index® mid-market du 4ème trimestre 2023. Cet indice mesure depuis 2006 l’évolution des valorisations des PME non cotées de la zone euro ayant fait l’objet d’une prise de participation majoritaire au cours des 6 derniers mois.